|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

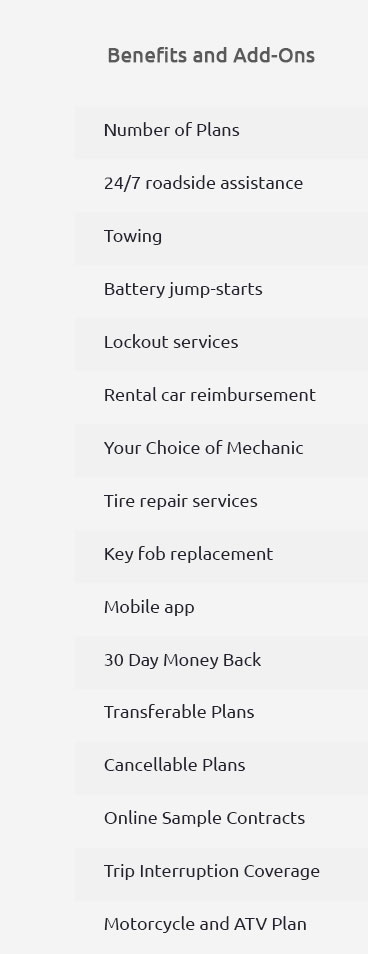

Mechanical Repair Insurance: Coverage Guide for U.S. ConsumersFor many U.S. consumers, mechanical repair insurance offers a valuable solution for managing unexpected vehicle repair costs. This type of insurance, often compared to an extended auto warranty, provides peace of mind by covering a range of mechanical failures. Let's explore how it can benefit you. Understanding Mechanical Repair InsuranceMechanical repair insurance is designed to cover the costs associated with mechanical breakdowns, which are not typically covered under standard auto insurance policies. This can include repairs to the engine, transmission, and other critical components. What Does It Cover?While coverage can vary between providers, most mechanical repair insurance policies cover:

It's essential to review the policy details to understand what is and isn't covered, as some parts might be excluded. Benefits of Mechanical Repair InsuranceThere are several benefits to having mechanical repair insurance:

For example, drivers in Phoenix, Arizona, who frequently face high temperatures, might benefit from a plan that covers air conditioning repairs. How It Compares to Extended WarrantiesWhile both mechanical repair insurance and extended warranties aim to protect against repair costs, there are differences: Extended warranties are often tied to the vehicle's manufacturer, such as those available through Nissan auto extended warranty programs, and may offer more comprehensive coverage. Mechanical repair insurance, on the other hand, is typically more flexible and can be purchased from third-party providers, which might be appealing for those looking for tailored options. Choosing the Right PlanWhen selecting mechanical repair insurance, consider the following:

Residents of California, for instance, might prioritize plans that offer roadside assistance, given the state's vast highways and potential for long-distance travel. FAQWhat is mechanical repair insurance?Mechanical repair insurance is a type of coverage that helps pay for the repair of mechanical failures that standard auto insurance does not cover, such as engine or transmission repairs. Is it worth getting mechanical repair insurance?It can be worth it if you want to avoid unexpected large repair bills and gain peace of mind. Consider your vehicle's age, model, and your ability to pay for potential repairs out-of-pocket when deciding. How does it differ from an extended warranty?An extended warranty is often provided by the car manufacturer and may offer comprehensive coverage, while mechanical repair insurance is a more flexible option from third-party providers, often with customizable plans. https://www.youtube.com/watch?v=Czi5qKRNNek

Mechanical Repair Coverage helps protect drivers from unexpected vehicle repair costs. Learn how MRC is different than Liability Insurance ... https://www.elephant.com/blog/car-repair-insurance

For mechanical problems, there is a coverage available called auto repair insurance, more commonly known as mechanical breakdown insurance ( ... https://www.allstate.com/resources/car-insurance/does-car-insurance-cover-repairs

But repairs for routine wear and tear or mechanical breakdowns are typically not covered by an auto insurance policy. From accidents to engine failure, learn ...

|